As tools are developed to watch the movement of coin over the Theta Network, it opens the doors of curiosity for those who want to know what’s going on before everyone knows what’s going on.

In this post, I’m going to show you how you can sleuth around using a couple public tools to get *some* information about the movement of funds, but not necessarily why the funds are moving. I would liken it to tracking an animal through the woods – you can see where the animal stepped, but not why they are on that path. Yet, if you’ve observed that animal enough, you may form an opinion regarding how it behaves, thus you can form a thesis that may hold up.

Let’s start with something that might be interesting – large Theta movements. To keep the level of interest up, let’s pick out a few recent large movements. We’re going to specifically look at the movements that Theta Ecosystem mentioned on twitter here.

I don’t know what service was used to get that info, but I’ve got tools to help me figure it out.

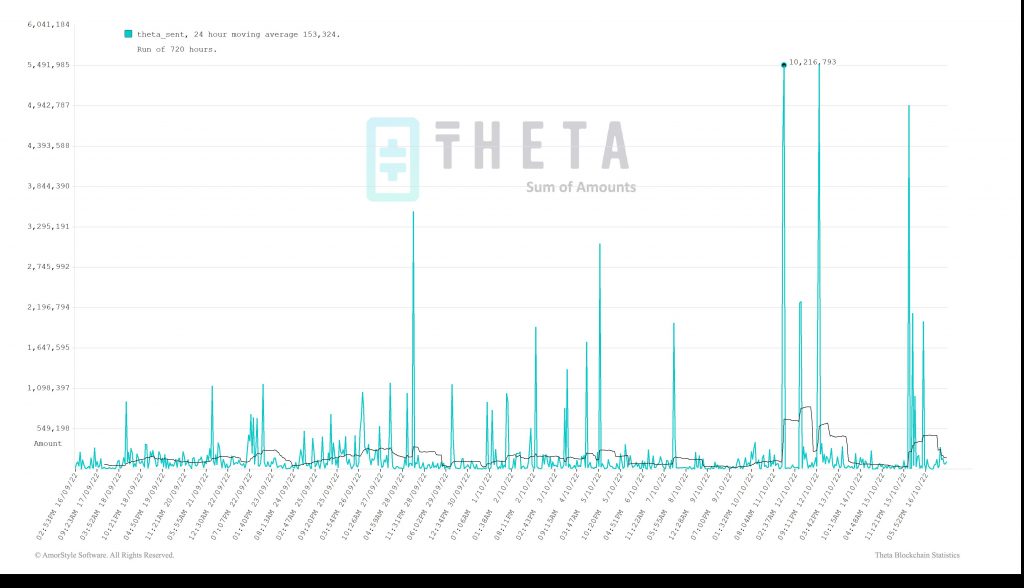

To start with, here is a graph showing the Theta transfers over the last 30 days as grouped by hour.

As you can see, there was an almost 5M Theta spike a few hours ago followed by a few smaller transfers.

And, because Theta is used as collateral for Validator and Guardian Nodes, if these transfers happened after the unstaking delay, they would show up in the chart that follows the ‘pending withdraw’ process.

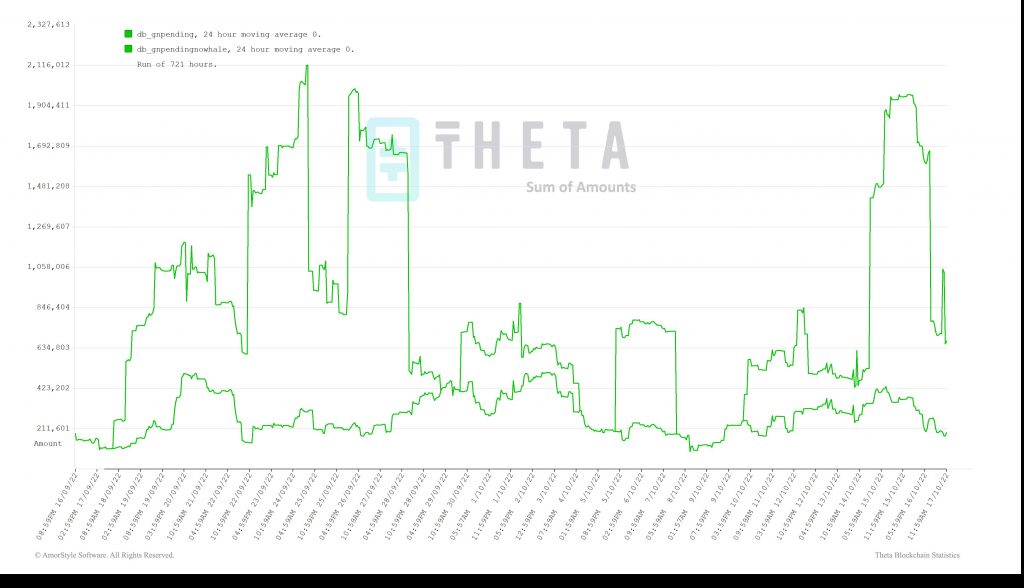

Here is that chart covering (effectively) the same time period.

Seeing that the graph is suggesting that we’re just coming off of a withdraw peak, some of these coins may be associated with that. Well see clues if they are.

Normally, you wouldn’t have these charts and you’d simply use a whale tracking service, like ThetaPizza on Twitter, or an explorer like ThetaScan.io.

ThetaScan shows that there was a transfer, 1 day ago between Binance 1 and Binance 3 of about 4,918,428 Theta. The transaction hash is: 0xc54a5a7b71045b482a60976aa8301e2342f277084c3a84f8f4e9a3ef990afc5f.

Continuing down the ThetaScan list, we can gather all the transactions that happened “1 Days” ago. Here they are:

7) 17533256 Address to OKEX 980,392

6) 17532547 Binance 1 to Address 150,000

5) 17532521 Binance 1 to Address 980,382

4) 17532508 Binance 1 to Address 980,382

3) 17530324 Binance 1 to Binance 2 4,918,428

2) 17528266 Address to Binance 1 50,000

1) 17528169 Address to Address 50,000

(By the way, if the ThetaScan people see this, it would be nice to be able to sort via block numbers or age on their top transactions page. The default is volume.)

Because the information was sorted by volume rather than time, I’ve included the block number and ordered them in time – oldest transfer is on the bottom.

Now, some of the data isn’t interesting. Like, the Binance 1 to Binance 2 transfer. Binance is the biggest liquidity pool for Theta so we would expect them to be moving coin around and balancing their books. (See reference below for Theta daily transfer volume).

The three 980k Theta transfers seem more interesting. Let’s start with the oldest transfer, number 4 above (block 17532508). The receiving address is 0x924018442579fab39efa009ce6bf6051ce775a7a. If you investigate this address, you’ll see that it was created a day ago. It was seeded with 129 Tfuel from Gate.io, followed by another transfer from Binance 1 of 10 Theta. Then, there looks like a self-to-self trade of 1 Theta. All this happened before the ~1.1M Theta arrived from this block number 4 (above 17532508) and the later block number 6 (above 17532547).

Now let’s look at number 5 (above block 17532521) which had a related amount and was sandwiched between the previous two transactions. This transaction went from Binance 1 to 0x63591f92a4d167b40b5074222f1b759e61241ad6. This account has a little bit more history behind it. If you review it on the default explorer, and you toggle back to the first transaction, you’ll see it was created a year ago. That first 10 Theta came from Binance 1. And, if you look at the ‘outs’, they all go to the same address (0x67f9d949f3b06a1f45f5a0a2d7d8a82bccf3815f). If I hover my mouse over the OKEX label that I see in ThetaScan, I see this address. Thus, number 5 above went to an account that only outputs to OKEX.

So, this volume moved from Binance 1 to OKEX AND, if you look closely, you’ll see that block 7 (above 17533256) is the completion from the previous paragraph.

At this point, it looks like the “Binance to address” and “Address to OKEX” are just liquidity balancing by the exchanges. It would make sense for big exchanges to buffer coin on other exchanges in order to take advantage of arbitrage. It would also make sense in order to secure liquidity.

If the coin moved through an address that staked, I would be way more curious. It would be at that point that there is an obvious 3rd party involved. But I don’t see that there.

Summary

No need for the fancy ‘pending withdraw’ chart. If we wanted to track down that info, you could use the same tools but it doesn’t look related to these big transfers.

Would I see this as an obvious sale or purchase by an individual? No. More of standard exchange gathering/releasing of coin.

But, this onchain volume doesn’t seem to show up in the trading view volume that Binance reports. So, it was either held at Binance by OKEX or it’s the summary of lots of small volume.

Poking around, I can see that OKEX did $1Billion worth of Theta volume over the last week (See WorldCoinIndex Image below). This could suggest that the movement of coins is needed to support this OKEX volume (CoinMarketCap image of exchange percentages below). Note that OKEX was founded in China but serves over 200 countries – just not US.

Executive summary

The simplest solution is that this is load leveling between exchanges. Anything else would requires other data sources to help draw the conclusion.

Reference

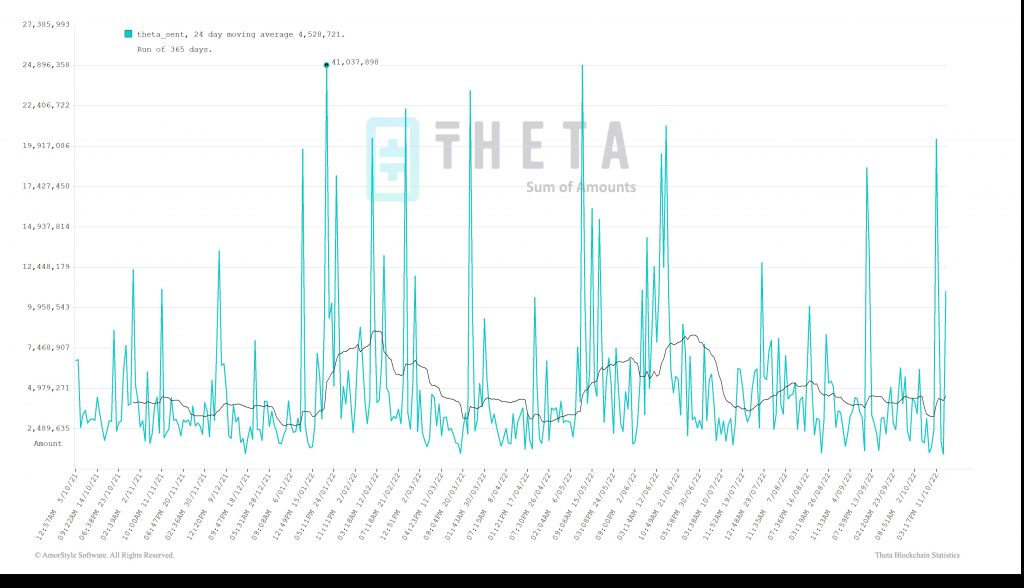

Theta Daily Transfer Volume

Here is a chart showing the Theta sent over the last year by daily volume. The average per day is hovering around 4M.

Trading volume for Theta as reported by Binance. This is a day chart where I’ve placed my mouse at about 1M volume on a daily chart. The last few weeks have shown volumes much less than 1M.

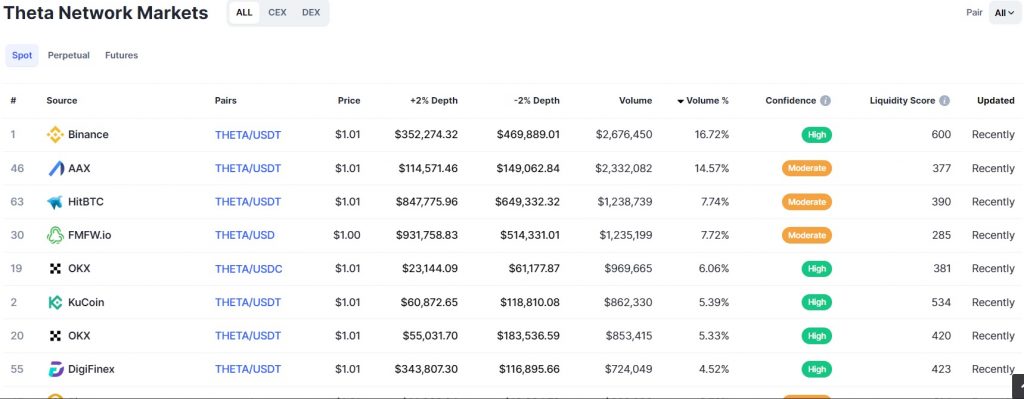

From CoinMarketCap website. OKEX is accounting for 11% of the trading pairs for Theta right now.