This is your opportunity to support project growth on the Theta Blockchain!

I am offering up NFTs to the community that can be redeemed for my time helping you launch NFT projects using the Selene Network.

Because it takes time to build and grow, the raffle will span the calendar year of 2025.

Key points

- NFTs are about $10 worth of coin.

- After the first raffle, tickets will be sold in ETH, BNB and POL.

- This NFT pays Agents 65% commission for sales and 15% for IT support.

- The prizes are outlined in the whitepaper, maybe $15k worth.

- It’s all about growing the Selene Network.

There is time to get involved, for growing the network means getting Partner Agents registered so they can capture the commissions and installing the core software so multiple website can participate.

The prizes will be distributed throughout the year, thus buying in early gives you more chances to win (1 raffle, multiple draws, etc).

More importantly, it gives Partner Agents time to find the network and get signed up. And, as prizes are claimed and get dropped onchain, the Agents will have more to talk about.

Support this Project

This is a new way to sell NFTs using blockchain for settlement while empowering content creators to be able to manage how they compensate their fanbase or loyal influencers.

Install Metamask, connect to this website (or any partner website) and see the process in action.

Also note that the Selene Network core code is tokengated on holding a soul bound Participant NFT. The code will help you acquire that NFT.

Where is this NFT mintable?

Anywhere there is a server running the Selene Network software. Right now, there are two locations (I’ll edit this page as more installs request it).

Where you mint matters!

If you mint from me, my Partner Agent and website will collect the commissions. If you mint from an affiliated site, they get the IT commission and present their Partner Agent Id in order to collect commissions. If you mint presenting a Partner Agent id on the URL, that Partner Agent will receive the commissions.

Here are some examples

To mint from me using Tfuel:

https://AmorStyle.com/dsn/?contract=0x9aff5efe24084fb7788472193afe734be775e4e4

To mint from an affiliate using Tfuel:

https://ThetaPollinator.org/dsn/?contract=0x9aff5efe24084fb7788472193afe734be775e4e4

To use your own agent id, you have to build the URL:

https://Affiliate.website]/dsn/?contract=0x9aff5efe24084fb7788472193afe734be775e4e4&agent=The_Agent_Id

To mint using ETH, BNB or POL:

Click the home button in this advertisement block at the top of the page.

If you want to mint from an affiliate site (like Theta Pollinator), follow the link above.

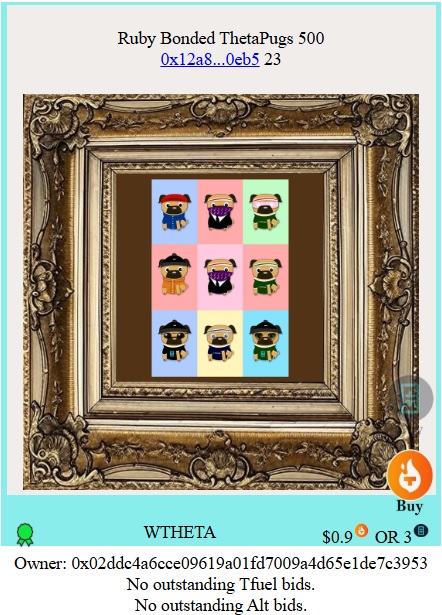

Projects in Raffle

The following three projects are what is being offered for the raffle.

Note that the home icon takes you to the location where the project can be minted, the “WP” icon links to the project whitepaper and the copy icon captures the home URL for switching browsers (if you’re on mobile, you need to use the mobile Metamask browser).

Disclaimer

As with launching any new project, there may be issues that need to be fixed. Hopefully, all the issues will be relatively small, thus fixable. If there is a critical issue, I have the ability to terminate the minting so that a reasonable solution can be found a presented in order to complete the process of enabling growth.